Stunning Claims at the HSV Pool Forum

At the HSV Pool Forum on March 11, 2019, Mr. Weiss, Chairman of the BOD and Mrs. Nalley, CEO made some stunning claims. We would like to address these claims and also the elephant in the room, deferred infrastructure maintenance.

Mr. Weiss said: ” We don’t have a debt situation“.

Mrs. Nalley said: “There has been no defined nine million dollar debt number “. ( Using the word “defined” prevents an understanding of the problem until all known numbers can be determined.) The question becomes, when will this issue be fully acknowledged? How much more information is needed to acknowledge and fully address the problem?

Addressing deferred infrastructure maintenance

Cindi Erickson, Board Director, addressed the deferred maintenance on infrastructure issue at least twice.

- On October 13, 2018, Erickson sent out an email which mentioned the $40 million deferred maintenance on infrastructure issue. Erickson has concerns about this and would like to see the issue addressed.

- During February 20, 2019, Hot Springs Village Property Owners’ Board of Director meeting, Erickson again addressed the deferred maintenance on infrastructure issue by questioning Jason Temple, Chief Operating Officer, about the anticipated costs for culvert repair and replacement. Erickson stated that culvert repair/replacement will cost an estimated nine million dollars. Both Nalley and Weiss were in attendance at this February Board meeting when this issue was discussed.

- ***In an email received March 15, 2019, Erickson stated, “With regard to my questioning of Jason Temple at the February board meeting, please refer to the 1 hour 14 minute mark of the video of the meeting. In essence, when Jason broadly estimated around 900 culverts in total needing repair (based on an initial assessment of 210 culverts) – and when he said the cost of repair for each could be between $5,000 and $40,000 – I quickly calculated (during the meeting) that if each repair cost $10,000 on average (the low end of the range), the total cost to repair 900 culverts would be $9 million. My point in doing so, during the meeting, was to give him a chance to correct my understanding of the situation if need be. It was NOT a statement on my part that culvert repair/replacement will cost $9 million. The bottom line, to me anyway, is that this is a wake-up call that deserves more analysis and revenue solution(s) to address, as I said in my comments during the meeting.”

***We agree and understand this was not a definite number, but a wake-up call and the exact amount that will be needed is not known. It may be less and it may be more. Thank you, Cindi, Erickson for clarifying this issue.

Leeming’s report shows substantial subsidies

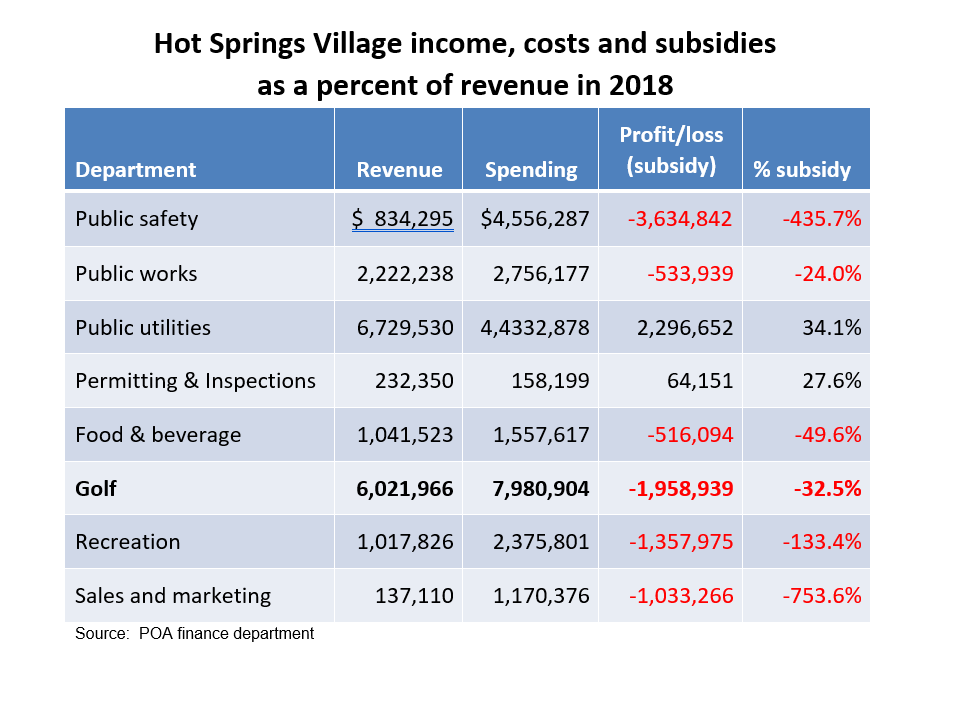

In Frank Leeming’s publication, titled “What’s Happening in Hot Springs Village”, updated on January 21, 2019, there is a lot of useful information. Included in this work is a chart titled, “Hot Springs Village, income, costs and subsidies as a percent of revenue in 2018”. In this chart, Leeming exposes the losses in most HSV categories in 2018. The only two categories not showing a loss in 2018 are Public Utilities and Permitting and Inspections. All of the remaining categories are subsidized with property owner monthly assessments.

Deferred maintenance on infrastructure is debt

There seems to be a huge blemish in the picture Weiss and Nalley are presenting in regards to the financial situation of Hot Springs Village POA. The information presented in Leeming’s factual chart suggests a different picture. Then when you consider both facts that deferred maintenance on infrastructure is considered to be debt, and only a few of the POA departments turn a profit, it seems as if the whole picture is not being considered by management. If deferred maintenance on infrastructure is indeed debt and we are subsidizing nearly all of our operations, this does not paint a pretty financial picture.

According to S & P Global in an article titled, “Between a Budget and a Hard Place: the Risks of Deferring Maintenance for U.S. Infrastructure,” addresses the issue of deferred maintenance on infrastructure being a credit weakness:

“But this spring when the state (California) issued $2.1 billion in new debt that was snapped up by investors, we cited as a credit weakness the state’s infrastructure profile–it has a backlog of deferred maintenance that even the governor’s budget summary is calling ‘staggering’.“

Strategic Partnerships Incorporated, in an article titled, “Deferred maintenance…the same as debt? Really?”, has this to say:

“At the state level, deferred maintenance is not quite as grave a concern as it is for local governments. In fact, 29 states have funding mechanisms in their capital budgets to cover maintenance. That’s rarely the case at the local levels of government.

“The looming problem, and the one that will force a change, is that deferred maintenance is now being counted as debt. That’s a very serious problem.“

Hot Springs Village POA is our local level of government and has a huge backlog of deferred maintenance on infrastructure. It is very disturbing that this issue doesn’t seem to be taken into consideration when planning projects. This has the potential for lowering property values.

Board should address & acknowledge issues

When it is determined that there is an issue which could harm property values, then the board should address the situation and deal with the problem. It is possible they do not acknowledge deferred maintenance on infrastructure as debt. If so, then they are not taking into full consideration the total financial situation of Hot Springs Village POA. The deferred maintenance on infrastructure does not seem to be something they are using when making financial decisions. By ignoring the elephant in the room, this leads to a situation where they seemingly spend on any project they want, no matter the cost and whether it is necessary or in the best interest of the property owners.

New Urbanism – another possible financial risk

It is the POA’s plan to transform our beloved Village into a New Urbanism Town/City Planned Development which will remove the retirement concept. We feel the New Urbanism Comprehensive Master Plan will also place an unnecessary financial burden on property owners in the community and push out fixed-income property owners.

In effect, this New Urbanism Comprehensive Master Plan could possibly lead to the demise of the “Greatest Gated Retirement Community in America”. The New Urbanism Comprehensive Master Plan is not a “gate-friendly” plan nor is it a “retirement-community-friendly” plan.

The BOD seems to rubber stamp every huge financial decision. They appear to be working hard at spending our money. The latest example of this is the $1.25 million, noncritical outdoor swimming pool. We feel this is unnecessary at this time and something that should be considered only after the critical deferred maintenance infrastructure issues are addressed.

Reasonable spending is desperately needed

The CEO stated at the pool forum that they were considering a bond program in order to address the critical deferred maintenance on infrastructure issue. It is not acceptable or responsible to spend 1.25 million dollars on an unnecessary frivolous project while borrowing money for the basics.

New board members are on their way. Let’s hope a few of the current board members will have a change of heart and join in the determination of the new board members to help make better decisions for the future of Hot Springs Village.