By Cheryl Dowden, November 20, 2021

HSVPOA Unimproved Delinquent Lots Show Increase from 2016

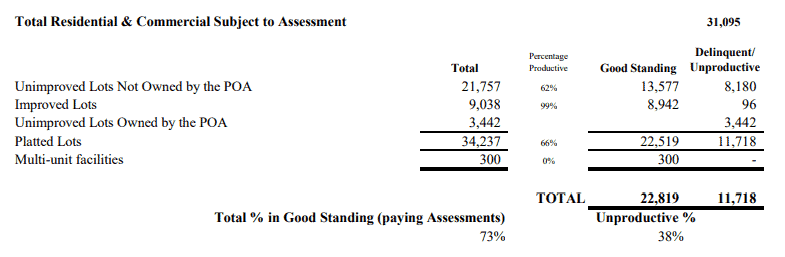

This report is mainly addressing unimproved delinquent lots. Lots not in good standing are those that are not current on their assessment payments.

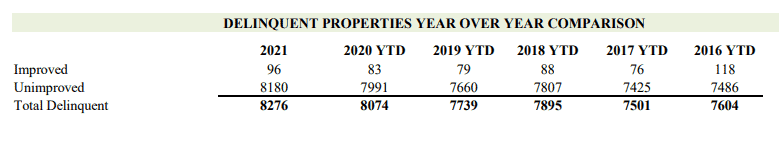

According to the Hot Springs Village financials published in the November Board packet (November 20, 2021 Board meeting), unimproved properties have been trending upward in delinquencies in the past few years. In 2016 there were 7486 unimproved lot delinquencies. 2017 showed an improvement with 7425 unimproved lot delinquencies. This improved number did not last long as there was a marked increase in unimproved lot delinquencies in 2018 with the number rising to 7807. In 2019, the number of unimproved lot delinquencies again showed an improvement from 2018. But years 2020 and 2021 yearly unimproved lot delinquencies totals have again been trending upward and the most recently published dashboard number currently shows 8180 unimproved delinquent lots in 2021. Keep in mind, the 2021 number currently published will not reflect the final number for 2021. This number could increase even more. (Hopefully, this will not be the case.)

* * *

Delinquent Properties Year-Over-Year Comparison 2016 to 2021

* * *

Comparing Unimproved Lot Delinquencies Between July & October 2021

Let’s take a more detailed look at 2021 and compare the unimproved lot delinquency numbers month by month so we can determine if there is at least a short-term trend here.

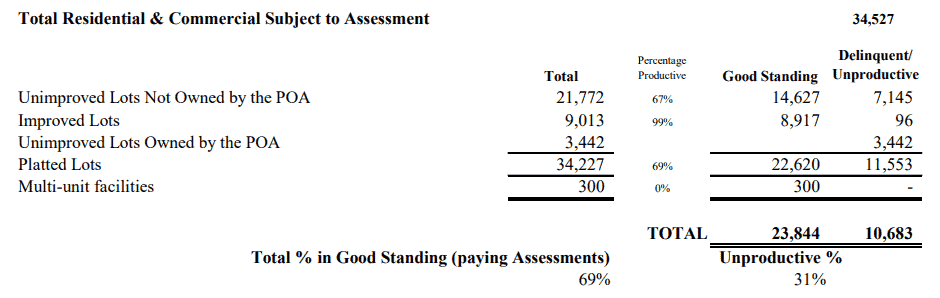

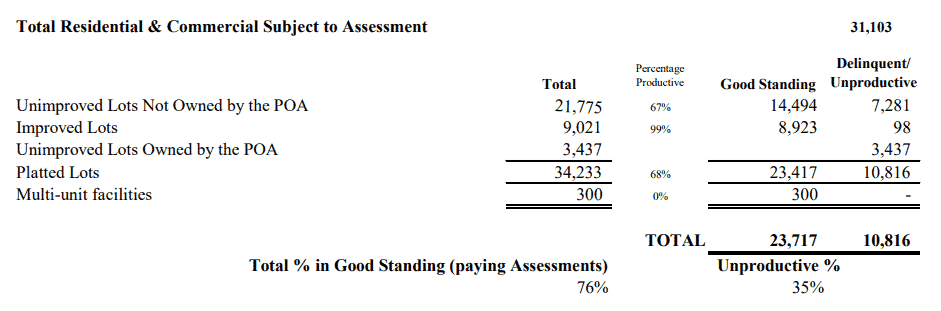

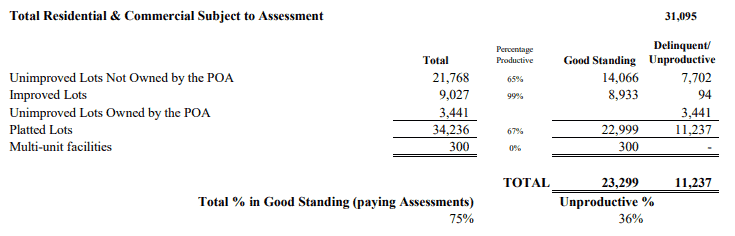

For the sake of simplicity, we shall only look at the numbers published between August and November. (Please see the screenshots below.) During this 2021 time period, Hot Springs Village unimproved lots in good standing have been on a downward spiral. Please keep in mind that the numbers reported at the Board Meetings run a month behind. For example, the numbers presented at the August Board Meeting are actually for the July financial report.

The screenshots posted below show the total residential and commercial lots subject to assessment. These screenshots show both improved and unimproved lots in addition to the POA lots. These numbers also show both delinquent (unproductive lots) and lots in good standing.

* * *

July Dashboard Numbers (Taken from Financials in August Board Packet)

* * *

August Dashboard Numbers (Taken from Financials in September Board Packet)

* * *

September Dashboard Numbers (Taken from Financials in October Board Packet)

* * *

October Dashboard Numbers (Taken from Financials in November 2021 Board Packet)

* * *

Of some concern are the numbers reported in the October and November dashboard. Namely, the number of unimproved lots in good standing reported in October was 14,066. The number of unimproved lots in good standing reported in November was 13,577. This means that in one month’s time period, there was an increase of 489 non-POA owned unimproved lots not in good standing. In other words, in one month’s time, the delinquency of unimproved lots increased by 489 lots. While the economy has taken a downturn, this number shows a marked increase in unimproved lot delinquencies in only one month’s time period.

On another note at the recent assessment increase vote, because of the decrease of lots in good standing, the number required to reach a quorum was reduced. Additionally, the POA reported that it did not need to use any of its votes to reach the quorum requirement for this vote.

If this trend (approximately two percent per month) continues, where will we be in 12 months?

* * *

Thank you for reading. If you like, please comment below. We love to hear your opinion, but comments must be made using your first and last real name, or they will not be accepted. If you would like to submit an article for publication, please contact us through this website. Be sure to bookmark this website.

Jayne Wente Staffeldt

11/20/2021 — 2:45 pm

Cheryl, Thanks so much for the information! Not what we want to see, but what we need to see.

Melvin west

01/03/2022 — 6:40 pm

Where do I find the call or email numbers for the different agencies in our village?

Is there a site that lists them?

HSVP C

01/03/2022 — 6:45 pm

Melvin, click here and hopefully what you need is listed. If Thanks. – Cheryl

Melinda Alvord

11/20/2021 — 2:49 pm

As you will recall, earlier this year it was reported that several very large blocks of lots were acquired in bulk acquisitions from the land commissioner. These are most likely acquired by “investors” who attempt to sell them in quick turn around sales using less than scrupulous sales tactics. These investors most likely have paid the transfer fees but have no intention of keeping the assessments current. The trick is for them to sell them off as quick as possible. What we may be seeing in these numbers reported now is a reflection of the assessments on these bulk sales now being at least 60 days delinquent. If this is true it would not be an accurate depiction of owners just deciding not to pay any more. Ideally I’d rather have a POA staff person provide more detailed explanation/ analysis.

HSVP C

11/20/2021 — 2:59 pm

Melinda, absolutely and NO WHERE did I say this was an accurate depiction of owners just deciding not to pay anymore. I said it was a trend in the past few months. 489 unimproved delinquent lots in the past month’s time are alarming no matter what the reason. I have no idea who or what caused this. Ideally, it would be nice if the POA put out a report on this. As they have not, we are forced to rely on the documents they publish. That is all I have done. You are welcome.

Susan Posner

11/23/2021 — 6:18 am

There should never have been any empty lot sold and closed upon. Lots should be “reserved” with a price, then building upon occurring and closing when such building is complete, with membership privileges commencing upon closing. I don’t know what brain deficient person sold lots with no commitment to build, that is not normal residential developing practice.

Kirk Denger

11/26/2021 — 5:27 pm

Where is the uptick recorded in the several blocks purchased that you mentioned? It looks like everything’s going downhill without any uphill trend.

Melinda Alvord

11/20/2021 — 3:06 pm

I’ll be happy to ask is they might have the time to put together a report on this. Maybe they just need to be asked. I don’t know this of course, but it doesn’t hurt to ask.

Susan Posner

12/03/2021 — 9:31 pm

Maybe ask how many Airbnbs are on residential streets that are violation of association documents, devalue neighboring homes and a security issue. Airbnbs are lodging verses the lease tenant which are housing. You buy into gated for security yet now have revolving door strangers coming in?! You as majority do; buy the biggest asset one has into an association because it is suppose to add more the value of homes vs not in one, adds a layer beyond zoning, is suppose to enhance community living; yet HSV POA has opposite effect?! All because you are in private not municipal with it’s state watch dog, all you have is small 7 member board with ones finding loop holes and altering ways for self dealing. Like 2 tier, no developer closes on empty lots they reserve lots in escrow with the building commitment completed before closing then membership begins. Boards letting selling/closing empty lots no intent to build for sake of membership that has little vested in here is totally why you have delinquent lots now.

Anne Shears

11/21/2021 — 10:14 am

I wonder if the delinquencies of 2020-2021 could be related financial stress caused by COVID. When times get tough and money is tight for a family, other things take priority– and things like investment lots, restaurant dining, new clothing and entertainment get dropped from the family budget.

HSVP C

11/22/2021 — 10:12 am

That makes sense and may account for at least some of the delinquencies. After the recent assessment increase, we may very well see even more delinquencies. I hope that doesn’t happen.